Today, we're excited to announce that the DeSo Foundation is launching a new platform called DAODAO.

DAODAO has been in development since mid-2021, and allows anyone to raise money for an idea from anyone in the world by setting up a new kind of entity called a DAO.

DAODAO is the first platform that makes creating a DAO as easy as setting up a social media account, and that makes investing in a DAO as easy as sending an email.

DAODAO also pioneers fully on-chain social features that can not only increase the role of trust and reputation in the investment process, but also allow DAOs to go viral in ways that haven't been possible in the past.

The creator of DAODAO is Nader Al-Naji, head of the DeSo Foundation and algorithmic stablecoin pioneer. Across DeSo and Basis, Nader's last project, he has raised hundreds of millions of dollars from thousands of investors, and built a strong track record for structuring and managing decentralized organizations.

With DAODAO, Nader and the DeSo Foundation team saw an opportunity to take all of the knowledge they've built up over five years of running decentralized organizations, and package all of those learnings into a product that anyone in the world can use to make their next bold and brilliant idea a reality.

By lowering the barrier to entry for creating a DAO, investing in a DAO, and engaging socially with a DAO, DAODAO can take DAOs mainstream the same way Coinbase did for tokens and the same way OpenSea did for NFTs.

However, unlike Coinbase or OpenSea, which are centralized companies, DAODAO will be a DAO itself, called the DAODAO DAO (of course). This will make it so that DAODAO will be a platform that's governed and owned by its users, rather than by elite venture capital firms and hedge funds.

The DAODAO DAO will be the first DAO to launch on the platform, and those who own DAODAO coins will receive 100% of all the trading fees from all DAO coins that trade on DAOSwap, DAODAO's companion on-chain order-book exchange, as well as 1% of the funds raised for all eligible DAOs that launch on DAODAO platform, forever.

Thus DAODAO presents an opportunity to not only disrupt investing, but also to fundamentally decentralize it.

To dive into the nuts & bolts we recommend reading the DAODAO whitepaper, or if you prefer video, you can watch this video by Nader Al-Naji, the Founder of DAODAO.

What are DAOs? - How DAODAO Works, and Its Potential

What are DAOs and how do DAOs work? The easiest way to explain this is to describe the process for creating and engaging with a DAO on DAODAO. In doing this, we will simultaneously explain both the concrete possibilities that DAODAO unlocks, and the future potential of DAOs as an asset class.

Step 1: Idea

The first step to creating a DAO is for someone to come up with an interesting, typically capital-intensive idea.

What kinds of ideas make for good DAOs? Well, from over a year of research, we strongly believe that DAOs can create real value for our economy by taking asset classes that were historically illiquid and private, and making them liquid and globally-tradeable, while also adding a social governance component to the mix.

The space of possibilities here is limitless and we believe many capital-intensive processes that currently operate via opaque back-room dealings could be re-imagined as collectively-owned DAOs.

To give some concrete examples, here are a few categories of potential DAOs that one could create using DAODAO:

Collectible DAOs

The most straightforward avenue for disruption for DAODAO is to allow for the fractionalization of big-ticket collectible items. ConstitutionDAO was the harbinger of this trend but, if we play out the mechanic, it becomes clear that a sophisticated platform like DAODAO makes it so that pooled funds can be used to purchase anything, including works of art (PicassoDAO), trading cards (PokeDAO), movie memorabilia (PotterDAO), and much more.

The potential of this mechanic is further enhanced when one considers the fact that DAODAO makes DAOs into an inherently social phenomenon, as we will discuss further in later sections.

Movie DAOs

Imagine if a writer could put a movie script or a trailer on the internet, raise money via a DAO, use the funds to produce the movie, and then redistribute the proceeds back to the DAO-holders. This would allow the writer to secure not just financing, but also a following before even making the movie itself. All while tapping into his most supportive group of investors: His fans.

Game DAOs

Imagine if a game studio could put out a demo of a video game online and crowd-fund the making of the full product. Fans who invest could not only get early access to the game, among other perks, but they would also get instant liquidity, as we will discuss, and they would also be entitled to distributions in the event that the game is successful, which DAODAO enables with just a single click, as we will also discuss.

VC DAOs

Today, if you, as an ordinary person, want to invest in blue-chip technology startups, you're out of luck. Virtually all of the financing happens through a handful of elite venture capital firms. But what if we, the people, could run our own venture fund? What if the next great app could be funded not by Silicon Valley elites, but rather by an army of the people, the users.

The DAODAO platform would also allow us, as both users and owners, to enforce better governance decisions over the apps that have such a far-reaching impact on our lives, as we will discuss.

By pooling funds into a VC DAO, ordinary people can create a value proposition to founders that has never existed before: Instead of taking money from a few elite investors who will jockey for board seats and do little to help their startup, founders can submit their startup to a VC DAO, funded by thousands, or perhaps millions of actual users, who can then collectively vote on whether or not the startup should receive funding.

If the vote passes, the founder would end up not just with the capital they need to run their business, but also a massive social following of people who are, literally, invested in using their product, and excited for them to succeed before they've even started.

In the extreme success case, we believe that getting backed by a VC DAO would be like getting the publicity of being on Shark Tank, but with better terms.

Community DAOs

Imagine someone in a small town, or in an under-represented neighborhood, wants to start a business to improve their community. It could be something as simple as a restaurant or a coffee shop. Where do they get the money?

Historically, they'd have to turn to banks, which would likely offer them onerous terms. But with DAODAO, they can launch a DAO and receive funding from anyone in the world. DAODAO not only enables this kind of global financing for the first time, but it also enables the investors themselves to get liquidity on their investment much earlier, as we will see.

SPAC DAOs

Imagine a major shareholder of a private company wants to sell a large chunk of their ownership. Historically, this would require finding a buyer in a highly-illiquid market. Instead, with DAODAO, the shareholder can wrap his shares into a DAO and effectively fractionalize and liquify that ownership across thousands, or perhaps millions, of investors all over the world.

DAODAO doesn't just enable this kind of transaction, but it also provides a perpetual source of liquidity for the asset after the transaction closes, as we will see.

Importantly, a startup founder could theoretically use DAODAO to wrap a percentage of their company's equity and raise on it in much the same way that they would raise from an AngelList Syndicate today. However, unlike a syndicate, investors would have instant liquidity on their investment, as we will discuss.

In the endgame, this model would allow founders to raise directly for a project from anyone on the internet, without the need to resort to raising venture capital.

In some sense, while VC DAOs can disrupt the demand side of the venture market, SPAC DAOs can simultaneously disrupt the supply side. The end result is decentralized VC DAOs coordinating investments on-chain into SPAC DAOs, which then coordinate their activities on-chain as well.

Step 2: Mint a Coin or NFT, and Sell It To Raise Capital for the DAO

Once the idea is established, people can invest capital into the DAO in exchange for a coin or NFT that represents ownership in the DAO, and that gives them governance rights over the DAO. DAODAO will support just coins to start, but will support NFTs in the future as well.

In the case of DAODAO, all DAOs start with a fixed-price round whereby 1,000 coins are issued for every 1 USD someone invests (configurable by the founder of the DAO). After closing the first round, the DAO can create another round at a higher or lower price. The fixed-price model makes it easy to issue a refund if the DAO is unsuccessful: Just give everyone back the money that they put into a particular round.

Some coins can be "reserved" for the DAO founder. E.g. the founder can specify that 10% of each investment goes to them. Using the previous example, an investment of 1 USD would result in 900 coins going to the investor, and 100 coins going to the founder. Such a mechanism can improve the alignment between the DAO founder and the other DAO coin-holders.

Note that DAODAO allows one to invest using many different currencies, not just USD, and will initially support fiat, ETH, BTC, SOL, USDC, and more. Treasuries will also be allowed to be kept in any currency, with instant swaps between currencies occurring behind the scenes after each investment.

DAODAO will also allow the DAO founder to set a referral rate that will go to anyone who refers a contribution to the DAO. In the event someone is referred, the amount will go to the referrer, but if the contribution was made without a referrer, then the amount will go to the founder. The founder can then burn the amount they receive via this mechanism if they want, but having it set up this way prevents misaligned incentives.

Step 3: Trading

Once a user has a DAO coin, they will be able to exchange it back for another currency or coin using an on-chain order-book exchange that will launch with DAODAO called DAOSwap.

Note that exchanges on most DeFi platforms are not order-book exchanges because most blockchains cannot handle the storage and indexing requirements of such exchanges. Rather, they are liquidity-pool exchanges, meaning that a significant amount of capital must be staked at any given time to support trading.

This is inefficient compared to an order-book exchange, where capital does not need to be tied up in this way. Thus, DAODAO can maximize the liquidity available for the secondary trading of DAO coins in a way that liquidity-pool exchanges cannot.

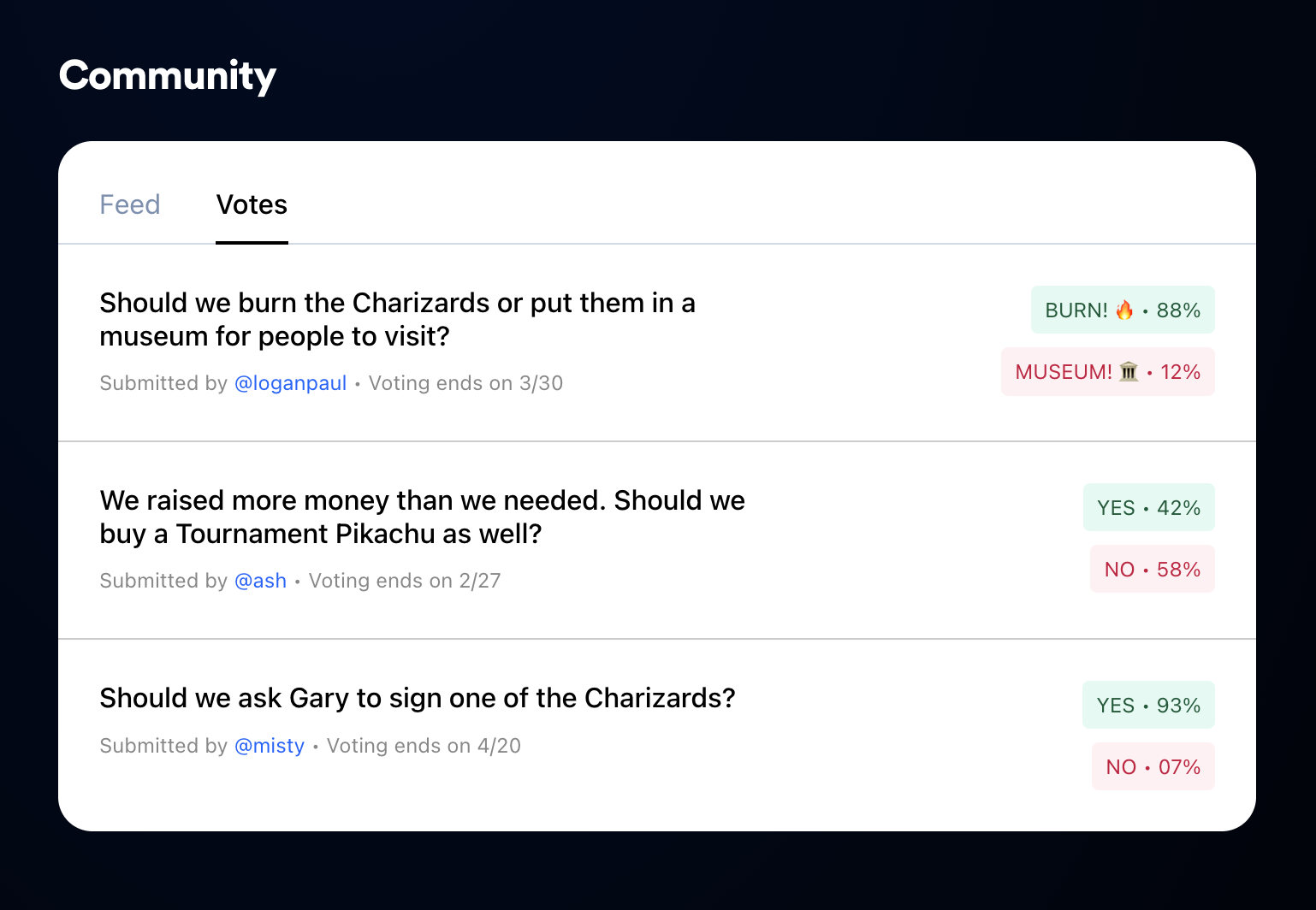

Step 4: Voting

Once a DAO has raised a treasury, the actions of the DAO can be controlled by a vote of the coin-holders on DAODAO. The fact that a DAO makes key managerial decisions by voting, rather than solely by the discretion of a centralized entity, is a key property that distinguishes a DAO from a traditional investment entity.

Notably, DAO votes held on existing tools like Snapshot and other tools are entirely off-chain, serving mainly as a tallying mechanism. There is typically no direct link between the outcome of a vote on Snapshot, and the treasury movement that the vote calls for. Instead, DAO treasuries are usually held as a multi-sig wallet across a few key members, and DAO-holders are required to trust that the owners of the multi-sig wallet will carry out the outcome of the votes.

Most DAOs today operate with no native on-chain form of identity and no way for operators to build a track record, significantly increasing the risk that one invests in a scam.

Most DAOs rely on fully centralized platforms like Telegram, Discord, or Twitter to engage socially. This means that even though a DAO is ostensibly decentralized, ironically, most major decisions are deliberated on highly-centralized platforms.

DAODAO will improve on the status quo significantly here by storing votes on-chain, implementing native identity on-chain, and implementing a slew of social features on-chain as well. In the success case, all communication on DAODAO will be published on-chain, and DAODAO will be very close to achieving this vision at launch, with virtually every important mechanic happening entirely on-chain.

Step 5: Socializing

DAODAO is an inherently social platform, allowing one to follow any DAO or person on the platform, with all follows stored fully on-chain with no lock-in. Similarly, users can create profiles, which are stored on-chain, make posts, which are also stored on-chain, and have a full feed of all of the activity from the DAOs and users they follow. DAODAO also supports fully on-chain encrypted and unencrypted groups chats, as well as end-to-end encrypted DMS.

The best part is that, because everything will be stored on-chain, users will be free to use whatever client they prefer to engage with other users and DAOs. It also presents an opportunity for devs to build competing experiences that fill gaps that DAODAO misses.

Step 6: Distributions

Once a DAO has allocated its funds, it can generate cash flows off of its assets. DAODAO presents a one-click mechanism to distribute money to the holders of the DAO coins pro rata, or by other schemes (though pro rata is the simplest).

Importantly, the fact that DAODAO is crypto-native enables it to process distributions seamlessly compared to non-crypto platforms. In particular, all a DAO operator needs to do to kick off a distribution is to send funds to the same wallets that own the DAO coins, and all of the information required to do this is stored fully on-chain in public view. Additionally, because DAODAO is built on a low-fee blockchain, the cost of making these distributions will be virtually zero.

The process is so straightforward that even people other than the DAO operator can airdrop funds to DAO-holders. For example, in order to bootstrap itself, an up-and-coming DAO can decide to airdrop some of its coins to key holders of a related DAO to lock in some early support.

No matter where someone is in the world, they can receive a pro rata distribution if they hold a DAO coin at a cost of near-zero, even if the DAO coin has changed hands many times.

The Nuts and Bolts of DAODAO

Below is a summary of the key features DAODAO offers, most of which have never been implemented on any investing platform before:

On-chain Social Identity

DAODAO will support on-chain social profiles, including usernames, descriptions, and high-res pictures. If every DAO had such a profile, and if every investor had such a profile, even if pseudonymous, it would vastly increase the role of trust and reputation in the investment process, and minimize the number of scams and rug-pulls.

On-chain Social Content

Imagine a feed of content about all the DAOs you're investing in, and all of the people you follow, and what they're investing in. All stored on-chain so that you're never locked-in to a particular client.

If successful, DAODAO will achieve two missions at the same time: Mixing investing and social, and moving content on-chain and out of centralized platform monopolies.

On-chain Follow Graph

Ability to follow people and DAOs, with follows persisting on-chain so there's no lock-in. Imagine if you could be notified whenever someone you respect makes a new investment, or whenever a critical mass of your followers is excited about something, even if you're using totally different client apps.

On-chain Social Voting

Until now, votes using tools like Snapshot have occurred off-chain, locking DAOs and their holders into a particular client app. Imagine if every vote could not only occur fully on-chain, but also allow users to engage socially, integrating on-chain social identity into the voting and delegation process.

Omni-currency

Allow investors to invest with any currency, including fiat, ETH, BTC, SOL, and USDC. Allow DAO creators to use any currency as treasury, with automatic and instant conversion from the investment currency into the treasury currency.

Until now, DAOs have largely raised with ETH, because that was the only platform with any amount of DAO tooling. With DAODAO, we believe that DAO fundraising should be chain-agnostic, allowing communities from all projects to invest in big ideas together. As far as we know, DAODAO will be the first platform to achieve cross-chain DAO funding.

In addition to allowing anyone to invest with any currency, DAODAO will allow DAO operators to use any currency as treasury. For example, in the case of ConstitutionDAO, it would have been much better if they could take investments in ETH, but then immediately convert that ETH to USDC so they could submit a maximum bid without being subject to ETH's volatility.

DAODAO will enable this by offering instant conversion from any investment currency into the DAO operator's treasury currency of choice.

A True On-Chain Order-Book Exchange

Existing on-chain exchanges like Uniswap have been amazing at enabling trading on blockchains with onerous storage requirements like Ethereum. However, liquidity-pool-based exchanges are inefficient because they require large amounts of capital to be tied up providing liquidity that might not always be needed.

Order book exchanges are more efficient, but have, until now, been impossible to implement on-chain due to their onerous storage requirements. DAODAO will innovate here by creating what we believe will be the first on-chain order-book exchange for DAO coins called DAOSwap.

One-Click Distributions to DAO-Holders

Today, there is no easy way for a DAO to make distributions to its holders. Without the ability to "close the loop," DAOs will never reach their full potential as an asset class. DAODAO will offer a hyper-convenient mechanism for DAO operators to distribute proceeds to coin-holders. Simply deposit an amount of the currency of choice and distribute pro rata.

One-Click Social DAOs

Imagine if creating and fundraising for a DAO with all of the above features was not only possible, but as easy as creating an Instagram account.

The (DAO,DAO) DAO

Perhaps the best part about DAODAO is that it will be governed as a DAO (of course).

Compared to Coinbase and OpenSea, which are centralized platforms that have extracted rent for shareholders, at the expense of their users, with DAODAO, the owners and the users of the platform are one and the same.

Combine this with the fact that all assets and content are stored on-chain, and DAODAO sets the stage for a full transition from the closed, centralized platform monopolies of the past, to a decentralized ecosystem of apps built by grassroots devs all over the world.

The DAODAO DAO will be the first DAO to launch on the platform, allowing us to be the first testers of the platform.

DAODAO Economics

How DAODAO will monetize will be up to the DAODAO coin-holders to decide via on-chain voting. However, the platform will start with the following two economic components:

- 100% of DAO coin trading fees generated on DAOSwap will flow to the holders of DAODAO coins. DAOSwap is an on-chain order-book exchange that will launch with DAODAO to facilitate the secondary trading of DAO coins. The fee that will be charged on DAOSwap will be set via on-chain voting.

- 1% of the funds raised by eligible DAOs will flow to the holders of DAODAO coins. We say eligible DAOs because we believe it will be advantageous to waive the fee in certain instances, e.g. to attract a very prestigious DAO to launch on DAODAO. The fee can also be potentially increased by on-chain voting as well.

Some other suggestions:

- The DAODAO platform could charge DAOs launching on it to be featured prominently on the search page, and the fees from these features could be distributed back to the DAODAO coin-holders.

- DAODAO could charge a premium when it facilitates a swap from one investment currency to another, and distribute these fees back to DAODAO coin-holders pro rata.

The possibilities are endless, but the best part is that it's not up to us, it's up to the people — it's up to you.

Reserving Your DAODAO Coins

The initial distribution of DAODAO coins will be very simple: a contribution of $1 USD to the DAO will entitle the contributor to 900 DAODAO coins, with another 100 DAODAO coins going to the DAODAO founding team as a founder's reward.

Contributors will be able to purchase DAODAO coins using USD, ETH, BTC, SOL, USDC, and more. Everyone contributing to DAODAO will receive coins at the same price, except for fluctuations in exchange rates, and except that the founder's reward will be waived for those who purchase an early access NFT (more on this below).

To reserve your DAODAO coins today, you can purchase an early access NFT by signing up on daodao.io. Those who purchase an early access NFT will have the 10% founder's reward waived, and will receive their reserved coins when DAODAO launches. DAODAO coins will be trade-able on the DAOSwap on-chain order-book exchange, which is targeted to launch alongside DAODAO.

After DAODAO launches, anyone will be able to purchase DAODAO coins on the DAODAO platform for a period of a few weeks, after which contributions will close.

Additionally, the launch of DAODAO will also enable anyone to launch a DAO on the DAODAO platform, and experience all of DAODAO's benefits, including: investments in any currency (fiat, ETH, BTC, SOL, etc...), on-chain social identity, on-chain social content, on-chain follow graph, on-chain voting, one-click distributions, on-chain order-book exchange trading of DAO coins, and much more.

Why the DeSo Foundation is Working on DAODAO

A key question many might be asking is why the DeSo Foundation chose to build DAODAO ourselves. Well beyond the first-hand experience we had with seeing the gaps with existing fundraising and DAOs today, there were also a few other compelling reasons for us to do it.

The two most common requests we have heard from our community are: 1. Help increase daily active users, and 2. Make it easier for teams building on DeSo to access capital.

We believe that DAODAO is uniquely positioned to solve for BOTH of these problems. In fact, many of the first DAOs that will launch on DAODAO after our initial batch will be Octane-funded teams.

We also felt it was imperative that given the importance of these features, that they be made available as quickly as possible, while also keeping a high bar on user experience and security. The DeSo Foundation team has doubled in size in just the past few months, and is filled with talented and experienced people from some of the top companies in big tech and Web3. Furthermore, we are able to leverage our learnings from previous product launches and ongoing development of the DeSo protocol to ensure a high-quality end product.

.png)